American home owners together features built-up almost $thirty-two trillion home based security, with respect to the most recent research on the Federal Set aside. It staggering contour emphasizes the key prospective one to household security represents both for property owners and mortgage experts the exact same.

Towards average mortgage-holding homeowner standing on a guarantee stake value doing $three hundred,000, there is a great deal of opportunity waiting to become tapped. Meanwhile, total credit card debt hit a new list high of $step one.13 trillion throughout the next quarter out-of 2023, depending on the latest House Loans and Credit history about Federal Put aside Bank of the latest York.

From this backdrop, the borrowed funds Lenders Organization predicts that over another a couple of years, the may find high demand for debt consolidating, translating into the significantly more home guarantee financing. That have users carrying significant amounts of personal credit card debt and you will generous security gathered within their homes, there was a ripe chance for mortgage benefits to help you help and offer selection one to power house security to deal with such financial challenges.

Customized guidance

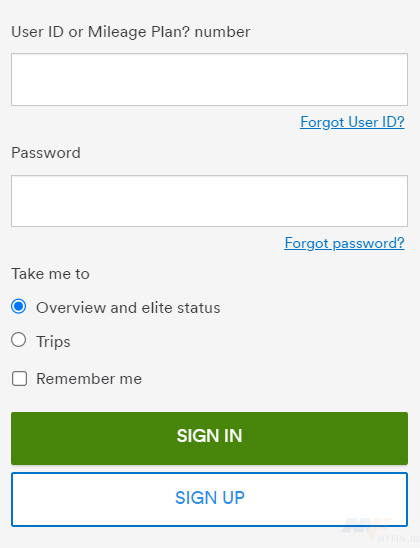

One of the first steps so you’re able to power home security effortlessly was trying to explain to consumers the various kind of domestic equity finance readily available and how they differ. A couple popular options were home equity fund and you may household security contours out of borrowing (HELOCs).

- House security mortgage. Labeled as next mortgages, household guarantee financing ensure it is homeowners so you can acquire a lump sum out of money from the guarantee in their home. These types of loans typically include repaired interest levels and you can monthly installments, which makes them a foreseeable selection for consumers.

- House equity personal line of credit. An alternative a house guarantee mortgage, a beneficial HELOC properties in a different way out of a timeless 2nd mortgage. HELOCs also use the borrower’s house collateral just like the guarantee, nevertheless operates a lot more like credit cards or revolving line out-of borrowing from the bank, allowing residents so you’re able to borrow secured on their residence collateral as required. HELOCs commonly incorporate varying interest rates, offering self-reliance and also a danger of interest fluctuations.

Whenever advising customers to your family collateral lending products, it’s crucial to make a comprehensive testing of its financial situation, needs and you may requirements. Specific clients could be trying combine highest-notice personal debt, although some is generally shopping for resource family renovations or covering higher expenses, like tuition or scientific debts.

You could tailor their suggestions properly and offer custom guidance that aligns making use of their financial requires. For example evaluating the benefits and cons of various household guarantee mortgage choices and you can determining and that services most useful suits the clients’ means.

Smart solution

A house equity loan tends to be a sensible provider to have subscribers seeking a lump sum of money to own a specific mission, particularly financing a house renovation investment otherwise layer an enormous bills. In lieu of other choices, a house security mortgage brings borrowers with a one-date lump sum.

A home guarantee loan is also a suitable choice for paying down debt. It gives consumers which have an appartment amount borrowed of money one are often used to consolidate and you can pay back higher-attract expense, such as for example charge card balance, unsecured loans or medical debts. So it lump sum payment allows consumers in order to streamline the obligations money into the one in balance monthly fees, possibly from the less interest rate than simply the established bills.

The following is a good example to take on: An individual which have an effective $3 hundred,000 first-mortgage at an excellent 3.5% interest rate looked for assistance from their mortgage broker so you can faucet specific of their residence’s guarantee. New representative recommended a great $95,000 fixed-rate domestic equity financing within 9%, permitting the consumer to handle high-attract credit card debt and you can money house home improvements.

Even with the excess loan, brand new buyer’s mixed home loan price lived amazingly lower at 4.82%. That it example features the possibility benefits associated with using house guarantee in the buyer discussions. It helps guide you leveraging domestic equity can offer diverse benefits to website subscribers while you are bolstering the total financial health.

Significant opportunity

The fresh big accumulation away from domestic guarantee one of American home owners merchandise a high opportunity for each other residents and financial masters. With almost $thirty-two trillion home based guarantee offered and the looming difficulties of record-high personal credit card debt, there was a definite interest in debt consolidation reduction alternatives.

Home loan advantages can enjoy a crucial role from inside the handling these types of monetary pressures by offering tailored choices that control household collateral efficiently. By knowing the all types of house security finance and you will performing thorough tests of clients’ needs and requirements, home loan advantages offer installment loan Atlanta GA individualized suggestions and you will information.

Whether it is investment household renovations, level higher costs or merging high-interest loans, house guarantee fund offer a functional solution to possess homeowners. Given that financial benefits navigate the home security land, they’re able to generate a significant impact on the clients’ economic really-are and build long-term relationships predicated on faith and you will possibilities. ?

Copywriter

Kim Nichols try head third-team origination development administrator and you can manages the agent and you will low-delegated correspondent development at the Pennymac. She also offers more than 30 years of expertise in different mortgage economic solution portion, as well as financial support segments, surgery, underwriting, and you can borrowing around the most of the development streams. Nichols registered Pennymac last year included in the key frontrunners group charged with strengthening the foundation for just what is starting to become the fresh premier correspondent trader in the nation.

Leave a Reply