So you can safe recognition getting a traditional financing, it’s crucial to demonstrate about 2 years from steady, uniform income with similar boss otherwise inside exact same profession.

- Income otherwise each hour earnings

- Incentives

- Overtime

- Percentage

- Part-day income

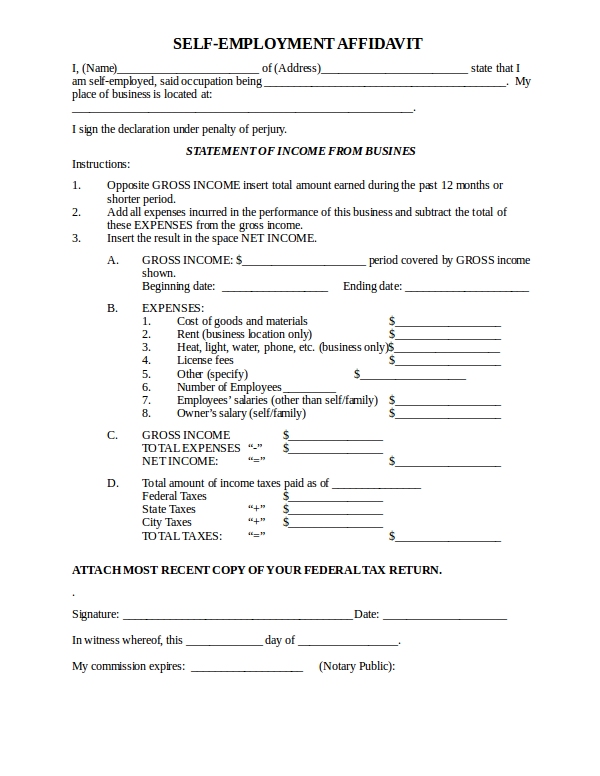

- Self-a career

- Deal or concert functions

Lenders have the ability to think even more sources of money getting qualifying motives. This can include some earnings channels eg retirement income, alimony, child assistance, and you will Public Coverage payments. Yet not, it is vital to observe that if you discover help costs such as for instance alimony otherwise youngster assistance, such payments must be expected to continue for at the very least around three ages shortly after having the financial.

All income source have to be recorded with your latest W-2s, taxation statements, bank comments, and you may pay stubs. Self-working borrowers, in addition, normally bring at the least couple of years regarding providers taxation statements when you look at the inclusion so you’re able to personal tax statements.

Debt-to-money ratio

Whenever determining your qualification to own a home loan, mortgage lenders look at the earnings when comparing americash loans Anderson to established financial obligation personal debt. Debt-to-earnings proportion (DTI) means new part of your disgusting month-to-month money assigned on the month-to-month debt costs (such as the upcoming homeloan payment).

To possess a normal loan, lenders prefer a beneficial DTI proportion not as much as thirty-six per cent. But not, DTIs doing 43% are commonly desired. Every so often, you may also meet the requirements which have a great DTI as much as forty five-50%, when you yourself have compensating circumstances. This type of issues may include a premier credit score otherwise significant dollars reserves held throughout the lender.

So you can estimate your DTI ratio, sound right their monthly obligations money and split one share by the monthly revenues. Eg, for those who have a revenues off $5,000 and monthly debt payments from $1,500, the debt-to-income proportion is 30 percent.

Loan limitations

To track down a conventional compliant home loan, the loan amount need certainly to slip contained in this regional mortgage limits put from the brand new Government Property Financing Company (FHFA). These types of loan limits changes a year, and tend to be high for the areas that have acutely highest property thinking. Within the 2024, this new conforming mortgage restrict to own an individual-house in the most common of the U.S. are $ , when you’re higher-worth loan limitations rise in order to $ . You can check the area’s most recent loan constraints right here.

Whenever mortgage quantity meet or exceed the maximum, borrowers need certainly to submit an application for a non-conforming financing or good jumbo financing. Jumbo money generally speaking require off repayments varying anywhere between 10% and you will 20% down.

Possessions requirements

- Single-family home or multi-unit home (no more than four units)

- A property, perhaps not a professional assets

On top of that, lenders possess coverage in position to make sure you dont obtain more our home will probably be worth. Once you’ve a finalized pick contract, your own home loan company commonly policy for a home appraisal to verify your revenue price doesn’t exceed this new property’s genuine market price.

Conventional loan conditions FAQ

It is simpler to be eligible for a normal mortgage than simply of many earliest-big date home buyers expect. Needed a minimum credit history off 620 in addition to a couple consecutive years of secure earnings and a job. Getting accepted and need a minimum advance payment anywhere between step 3 and 5 % and a personal debt-to-earnings ratio below 43 percent more often than not.

In the modern home loan landscaping, the notion you to definitely a 20% deposit is required try a myth. There are many home loan software, including antique money, that offer even more versatile deposit solutions. Some very first-time homebuyers can buy with only step three per cent off, while others will need at the least 5 per cent. Understand that to buy a house having below 20 percent down requires individual mortgage insurance policies.

Leave a Reply